Why Portugal Long Lets

Welcome to Portugal Long Lets website. We are a national portal of medium and long-term rentals, built on collaboration with individual owners and regional property managers. Our exclusive focus on rentals, with a network of individually owned and agent managed properties nationwide, sets us apart from the rest. We ensure zero fake listings and manually check availability to provide up-to-date information. We provide a range of value-added services and remain the point of contact during the rental term. Our inventory meets the requirements of seniors and retirees, as well as those with pets or requiring care. Discover why we are the regional leader in the Algarve and why Portugal Long Lets is much more than just a listing site.

Properties of which more than 100 are available for full annual rental

Increase in medium and long-term rental properties

Increase in rental volume relative to 2021

Increase in rental contracts of greater than 3 months

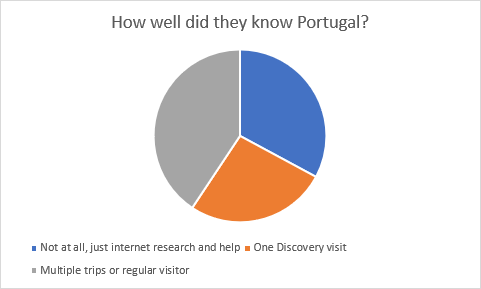

Many new residents or visitors to Portugal become familiar with the country via the internet. Increasingly, new residents and visa applicants are moving to Portugal without a physical visit. The Living In, Moving or Retiring to Portugal Survey, compiled from thousands of responses from people who have moved to Portugal or plan to do so, shows that over 40% of those who move to the country, had not visited at all.

- There is a long-term residential rental stock shortage caused by an increasing number of owners who have placed their properties on the short-term rental market. In the most popular areas, owners want to make as much money over the lucrative summer months as possible. Most real estate agents deal with rentals as an after-thought, listing, renting and then walking away. It is difficult to find a company which is simultaneously independent, offers coverage of multiple regions, and which provides properties across a range of types, views and prices. Portugal Long Lets addresses this market need.

Portugal Long Lets is unique for a number of reasons:

- An exclusive focus on rentals, and only on medium and long-term lets. Holiday lets are not allowed (properties with at least 6 month winter rentals and that operate weekly summer rentals, will be allowed to advertise their winter periods)

- It brings together a network of individually owned and agent managed properties, nationwide

- Zero fees for owners and property agents

- Zero fake listings! All owners have to provide property ownership documentation and property managers must sign a contract warranting the validity of information. Portugal Long Lets is much more than a listing site (where there is often limited oversight)

- Availability checked manually. While this may seem inefficient, it is the only way to guarantee that information from owners and managers is still up to date

- No negotiation and making offers: the terms and prices of the rentals, including any fees, are agreed with owners or property managers, all of whom sign agreements with us

- It is already the regional leader in the Algarve, and all listings on Algarve Long Lets appear on Portugal Long Lets

- We remain as point of contact during the term of the rental. Portugal Long Lets is much more than a list of properties that site visitors must then contact

- We provide a range of value-added services including draft rental contract template, NIF and ban account introductions, NHR application introduction etc.

- We do not represent the landlord over the tenant. We ensure a balanced solution

- As an overwhelming majority of our rental clients are seniors or retirees, we are uniquely positioned in that much of our inventory meets the requirements of that demographic (which in turn means it is excellent for many other market sectors as well), namely: walking distance to amenities and transport; accessible properties, either single floor properties or apartments served by elevators; proximity to services and if on the coast, to the beach; environments close to multi-lingual, expatriate communities; and suitably prepared properties such as those with good heating solutions for the winter

- We are specialists in sourcing accommodation options that allow pets

- We have fully-accessible options available as well as some long-term options for seniors requiring care

If we do not have a suitable option in our portfolio, where appropriate we recommend a search service in a collaboration with Property Finder Portugal.

In the latter years of the last decade, it was unquestionable that Portugal provided Europe’s best investment destination. A growing economy, falling unemployment, a recovering real estate market, an investment surge in real estate driven primarily by the very successful Golden Visa program, a wave of (mostly) wealthy foreign retiree immigration driven by the Non Habitual Resident program, all this fuelled by successive record-breaking years in the tourism industry, and no one could question the underlying fundamentals. Add to this the fact that Portugal had taken a long time to start to recover from the losses caused by the 2008-9 financial crisis, with property values falling as much as 40% in some locations. Even the Covid pandemic did not dampen the appetite for real estate investment in the country.

The result of the perception of an improvement in the investment climate and the many measures intended to stimulate the economy was a jump in foreign investment. No sector felt the impact of this increase in capital inflows like the real estate market. From Chinese Golden Visa investors to French NHR residents, the country’s real estate boomed and in 3 years, Lisbon had seen property growth of 60% and off-plan sales of modern, new-build product were back to full swing as if the recession had never happened. The latest wave of interest, in particular since 2020, from the American market, has further contributed to the price increases and the supply-demand imbalance.

Much of the growth was caused by investors who saw in Portugal not only an opportunity for capital appreciation from a low base, but also the possibility of rental yields. The country’s regulated, but very low tax, regime called the Alojamento Local, meant that early buyers who made their property available to the short-term rental market, were initially paying approximately 4% tax on gross revenues.

Since the early days of the program, changes to the local lodging (Alojamento Local) legislation were implemented, including:

- An increase of the taxation basis from 15% to 35% of gross revenue, meaning an effective increase in the base rate of taxation on short-term rentals from less than 4% to around 20%. A significant increase

- Application of employer’s social security for companies managing client properties

- Higher water rates in some municipalities for properties registered as local lodging

The need to present detailed calculations and proof of expenses, effectively eliminating the simplified regime for owners with annual rental values of around €27,000 - The potential for CGT on the transfer of property into an AL regime (an issue resolved by the government around 2020 after years of generating confusion and reoccupation for owners who had entered the market in good faith)

In 2018, with a number of complaints about the effects of excessive tourism and short-term let properties, and the adoption of stricter rules in locations as diverse as Paris, Barcelona, New Zealand, Thailand, and Croatia, meant it was only a matter of time before the government started to change short-term rentals even further. The beginnings of dissatisfaction with over-tourism, including the “expulsion” of local residents by (mostly) foreign owners, and leading to a loss of character of entire neighbourhoods which were the drawcard attracting investors and visitors alike to the country’s authenticity in the first place, started to put pressure on the government to act.

Changes to legislation forced the following changes:

- Municipalities had the right to define zones with quotas on the number of short-term let properties, and owners were be limited to a maximum of 7 short-term rental properties within these zones

- Local lodging licences are personal and non-transferable in these areas and so if the property is sold, the new owner may not be able to get the licence renewed if the quota for that area has been reached. This affected mainly historical suburbs of Lisbon and Porto

- Condominiums have the right to determine if and whether local lodging can be assigned to a property. Approval will require at least 50% of all voting members or owners. Later, a Supreme Court ruling upheld the right of any individual owner to request the removal of local lodging (AL) activity from a residential building

- Condominiums are entitled to charge a premium of up to 30% on condominium fees for those renting short-term (due to increased wear and tear of communal areas)

- Multi-risk and liability insurance is compulsory and must now also cover damage by clients to condominiums

- All client and tenant documentation must now be in three languages

The Golden Visa program, which had been the source of many foreign-owned properties introduced to the short-term rental market, suffered dramatic changes in early 2022, with all residential product in popular, high density areas of the country excluded from the program.

A year later, the government, after several warnings, publish a set of radical proposals under the heading “Mais Habitação” (More Housing) to radically reform the residential housing sector. Proposed measures included:

- Termination of the Golden Visa program to new applicants

- Restriction of Golden Visa renewals to those who had invested in real estate, unless that real estate became a primary residence or was placed onto the long-term rental market

- Gradual extinction of the Local Lodging (AL) program, with extra penalties to be applied in the interim

- Expropriation of unoccupied houses into the residential rental market, with the (slow paying or often non-compliant) government becoming the tenant with right to sublet. The government has extended its policing force to utility companies that now need to report homes with low consumptions

- The government has made it now possible for tenants to register rental contracts (much like the use of the NIF to control VAT at retail outlets and service providers, the government has opted to expand its policing force via the use of the general public), nonetheless a good measure to flush out owners who are not declaring revenues

- Rent control

- Local lodging (AL) licenses will expire by 2030 (unless associated with a mortgage in which case the AL license will remain valid until the mortgage is paid off), with the possibility of 5 year renewals subject to municipal approval

The result of these proposals, and their implementation, is that:

- There is a move towards longer-term, residential (versus short-term tourism) accommodation

- Golden Visa real estate owners will need to ensure their properties are placed onto the long-term rental market, unless they intend to occupy the properties themselves

Investors will need to migrate to using the long-term rental model as the basis for the calculation of yield.

- Winter lets and Long-term rentals are an excellent way to make extra revenue in months which are usually slow and where properties are closed

- Taxes and legislation surrounding short-term rentals have increased; AL licenses will end in 2030 and will be subject to renewal at the discretion of the local municipality; however tax on long-term rentals is subject to a progressively decreasing rate (albeit still higher than AL).

- In 2020 and 2021, due to many factors relating to Covid-19 there was a decrease in tourism to Portugal which had a direct impact on short-term rentals. However, long term rentals remained on track, so owners protected their assets by negotiating good long-term rental values. As Covid-19 cases settled and the “new” normal came into play, short term rentals saw an increase, but the search for long term rentals continues to growth. This growth in part related to the pandemic which saw an increase in digital nomads and remote working, but also to Portugal’s increasing appeal as a preferred residential destination.

- While the taxation is higher (28% versus around 14-20%, depending on VAT, for short lets), there are less expenses associated with long term lets such as utilities and cleaning as these are paid by the tenant and not included in the rental

- Security deposits are higher, churn is lower

- Owners have time to vet and select their guests. Checking references is possible

- Long-term tenants tend to be seniors or families. There is less damage and properties benefit from year-round occupation

- Stability: knowing that they have a place to stay throughout the year, without the price fluctuations of the expensive summer months

- Visibility of expenses allowing for better planning

- Expenses are controlled directly by tenants, so if they wish to use more air conditioning or heating, they pay the bill, whereas if they decide to use blankets, they can save

- Contracts will allow those tenants who qualify, to apply for Portugal’s D7 or D8 residency visa and/or low-tax Non Habitual Resident status

- Tenants cannot expect to find quality property in good locations at discounted prices: in addition to the boom in demand, long-term rentals are still taxed at higher rates than shorter rentals

- Many tenants looking for a long-term or annual rent, finding prices higher than they imagined, enter into a shorter contract in the slower winter months hoping they will then find something suitable when they are living locally. This often does not work for three reasons:

- The area selected is not necessarily the one in which they finally wish to settle. Their landlord is not knowledgeable of other areas nor has any interest in finding a solution which will mean losing a winter rental earlier than planned

- There may be a special requirement, such as pets, which makes the list of available inventory very short indeed. Companies like Algarve Long Lets have spent years compiling their portfolio of properties which often involves months of negotiation with owners. Even then inventory changes but due to a larger variety, finding an alternative is usually possible

- Every winter month which passes brings us closer to the expensive summer months which in turn sees a decrease in inventory and an increase in price. Often owners, who in November are nervous when they see an empty winter in front of them, become much more confident by March when they see the approaching summer months

- The largest challenge for tenants is to understand that often sacrificing one or more criteria in order to get a full-year rental contract, is better than sacrificing the length of time in the hope of then finding the perfect solution later. Without exception, the latter approach is always more expensive.

- Seasonality is crucial. In places like the Silver Coast and the Algarve, the best period in which to start a rental is between September and March. Pre-summer is difficult and during the summer impossible. Conducting “searches or visits” during the peak months is equally inefficient as properties are occupied with tourists and owners and managers or agents on holiday.

- Some owners do not register their rental contracts, something which the government is tackling under its new program by ensuring that tenants also have the ability to register the contract